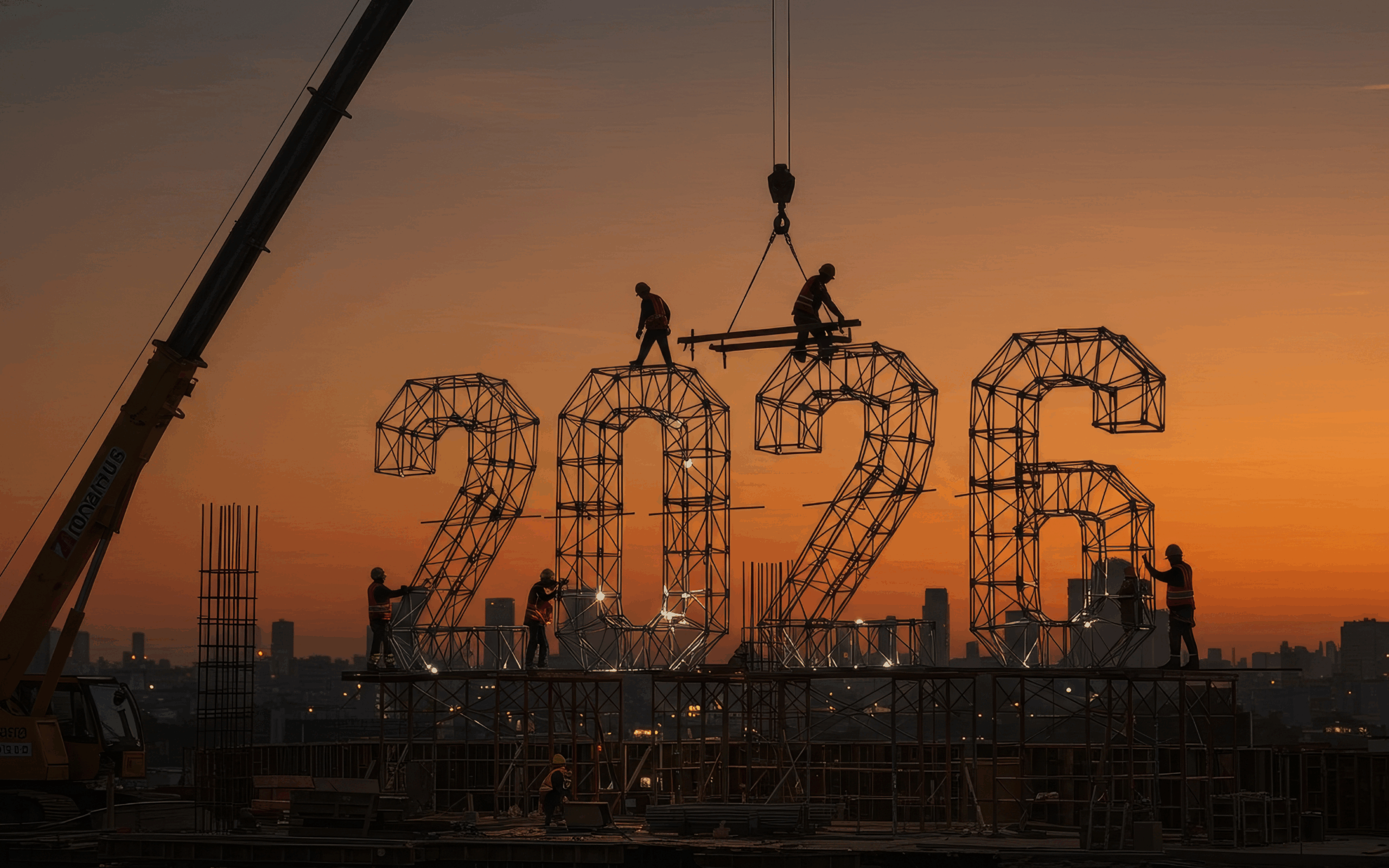

As we move toward 2026, individuals and businesses across all sectors are preparing for a year shaped by regulatory change, tax reforms, shifting economic pressures and new reporting expectations. From M&A activity and insolvency trends to sector-specific challenges, businesses will need to balance rising costs with opportunities created by greater stability and emerging innovation.

Sector experts from Menzies LLP share their key sector predictions for the year ahead, helping you plan with confidence and adapt to an increasingly complex landscape.

Legal Services

Peter Noyce, Partner and Head of Legal Services at Menzies LLP reports:

“The SRA has paused its major consultation on restructuring client accounts and capping or restricting interest until at least late 2026, so little is expected in the first half of the year, with consultation likely in Q3/Q4; nevertheless, firms may see early-2026 guidance reminding them that retaining significant interest requires explicit written client agreements, and “fair interest” policies—along with residual balances—will be key audit focuses.

“Firms should track management information excluding interest received to ensure profitability is driven by core legal work rather than interest income. The profession is also undergoing significant management change, with cash-is-king giving way to data-driven decision-making, rolling forecasts replacing static budgets, and increasing use of AI to predict WIP lockup and cash-flow gaps before they arise.

“Private equity interest in regional firms is set to grow further in 2026 due to strong margins and stable client bases, likely resulting in more unsolicited approaches.

“Finally, while premiums should remain flat or slightly reduced for well-run firms, insurers are now probing AI governance, making clear and well-documented AI-use policies essential.”

Forensic Accounting & Valuation Services Predictions

Matthew Haddow, Partner and Head of Forensic and Valuation Services, and Georgina Davies, Director of Valuations Services at Menzies LLP write:

“In the Forensic Accounting and Dispute world, there is likely to be a continuation of the shareholder disputes that have kept the market busy in the past year. Claims of unfair prejudice appear to be increasing, at least where Expert Valuation is being sought, and there is no sign that breach of warranty claims and earn-out disputes, arising from M&A activity, is slowing.

“The increased focus on litigation funding and group claims will remain, and there is likely to be more developments in the newsworthy matters in the Courts at the moment. A number of collective claims are due to proceed to trial or judgment in 2026. Of particular interest will be the design and operation of redress schemes.

“Fraud remains a big topic, with AI tools assisting practitioners but also fraudsters, making it more sophisticated and challenging to detect. The fresh “failure to prevent fraud” offence may also feature in breach of warranty claims.

“Valuation activity linked to tax and share schemes is expected to increase in early 2026. IHT planning, which includes share valuations will be a focus ahead of the anticipated changes coming into force in April 2026. The increase to EMI thresholds set out in the recent Budget will allow larger businesses to use EMI schemes, potentially driving a rise in demand for EMI valuations that are recommended on adoption. We anticipate a downturn in EOT transactions following the tax relief changes announced in the Budget.”

The full report

To view Menzies’ full sector predictions for 2026 (including the areas below), click here:

- General Market Sentiment for Deals

- General Market Sentiment for Insolvencies

- Not-for-Profit: Social Housing

- Not-for-profit: Charities

- Not-for-Profit: Education

- Manufacturing

- Technology

- Property & Construction

- Financial Services

- Recruitment

- Retail & Wholesale

- Transport & Logistics

- Hospitality & Leisure

Looking ahead to 2026

Looking ahead to 2026, it is clear that businesses will face a mix of challenges and opportunities driven by tax changes, regulatory shifts, technological developments and wider market uncertainty. Preparation and informed decision-making will be essential to navigating this landscape.

Whether you are managing financial pressures, planning a transaction, seeking growth or strengthening long-term resilience, Menzies is ready to support you and help you achieve your strategic goals in the year ahead.

Contact the specialists at Menzies today, here.