Investors have been debating the relative merits of active and passive investing for many years. While some appreciate passive funds’ convenience and low cost, others favour active funds’ potential to outperform the market.

Here, Greg Tait, Financial Planner, RBC Brewin Dolphin Wales, explain the differences between the two investment styles, and why combining the two can maximise returns for clients.

Passive investing

The objective of passive investing is to track a specific index, commodity, or basket of assets. If a fund tracks the FTSE 100, for example, its goal will be to match the performance of that index. As well as tracking well-known indices, passive funds might target more specific countries, sectors, industries, sub-industries or factors.

Passive funds provide a convenient and inexpensive way of gaining exposure to assets that might be cumbersome and expensive to buy direct (such as gold) or logistically challenging to buy direct (imagine investing in every company in the S&P 500!).

Passive funds may also prove useful when investing in an industry where the competitive environment is ever-changing. With cyber security, for example, the playing field moves with every new threat and resulting technology to combat it; it’s very challenging to select a couple of winners.

The downside of passive investing is there is no intention to outperform the market. The fund’s performance should match the index, whether it rises or falls.

Active investing

Active managers aim to outperform a particular index (their ‘benchmark’) by taking advantage of market inefficiencies. Active managers will hold stocks within their benchmark where they see opportunity for attractive returns, and omit holdings that they consider to be poor quality or expensive. They can also buy stocks outside of their benchmark.

Active managers look for opportunities where assets are mispriced. These opportunities are more likely to be in markets that are less well covered and less liquid, such as emerging markets and small cap stocks. At RBC Brewin Dolphin, we use active managers to gain exposure to such markets; their experience, knowledge and deep cultural understanding of their universes are of significant value.

Changing market environments might also present mispricing opportunities. Active managers performed strongly in 2020 when Covid-19 brought about dramatic and swift changes in consumer behaviour. The ‘stay at home’ stocks boomed while leisure stocks languished.

One of the biggest benefits of active management is that you can be the ‘tortoise’ rather than the ‘hare’ if you have the benefit of a longer time horizon. Warren Buffett and Terry Smith share our philosophy that companies with superior returns on investment with the opportunities to reinvest those proceeds at attractive rates, will outperform over the long run.

The downside of active investing is there is no guarantee that active funds will outperform their benchmark, particularly once the higher fees are taken into consideration.

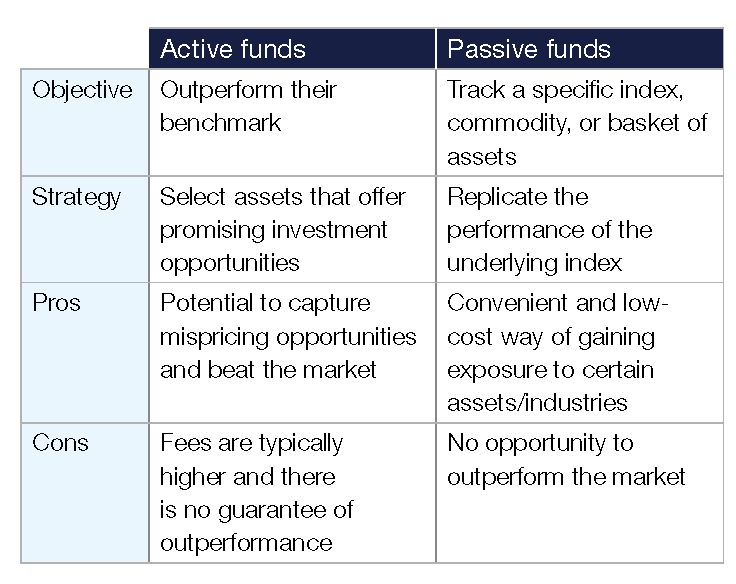

Active vs passive: key characteristics

Best of both worlds

We believe that active and passive funds both have a role to play in a diversified investment portfolio. Whenever possible, we invest in a core of individual equities that we believe will outperform our benchmark over the longer term, but will also access external active management capabilities in markets and strategies which are outside of our expertise. We use passive funds as a cost-effective way of achieving broader market participation, or more specific exposure on a short- term basis.

By utilising different assets that are available to us, we aim to steer portfolios through market cycles while capturing mispricing opportunities along the way.

For more information, please contact the RBC Brewin Dolphin team in Wales, here.

Disclaimer

The value of investments can fall and you may get back less than you invested. Information is provided only as an example and is not a recommendation to pursue a particular strategy.