Back in late spring, Sweetmans and Partners and Legal News Wales surveyed Welsh law firms to understand their pandemic experience.

The idea was that we would share the results to enable firms to benchmark their experience and support them with their plans to emerge successfully from the pandemic. 95 firms of all types and sizes from across Wales completed the survey and we’re delighted to now share the results.

Most firms have performed well financially

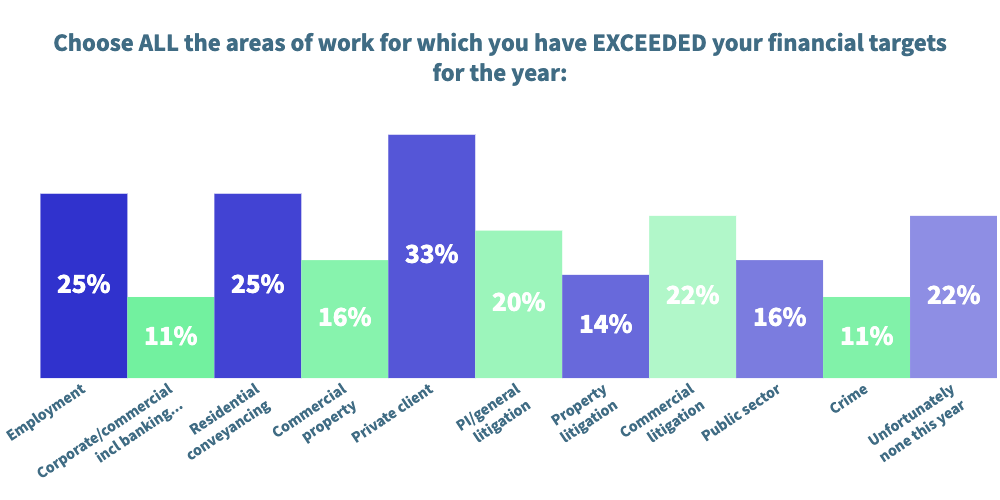

Overall, the sector in Wales performed well financially, with nearly 80% of firms reporting increases on fee targets in at least some practice areas.

Private Client, Residential Conveyancing and Employment performed the best, followed by the usual counter-cyclical areas of Commercial and General Litigation. Crime was another area in which some responders reported growth.

Even areas that rely on business confidence, like Corporate/Commercial and Commercial Property, were ahead of target for some firms. Public sector work was also up, as was property litigation.

Some of these increases can be explained by short-term, pandemic factors, such as: the stamp duty holiday; the furlough scheme; increased estate planning; additional public sector spending; and the impact of lockdowns on commercial rent commitments. But in other cases, more systemic, and long-term, factors are at play – which could result in some trends continuing.

Residential conveyancing is a good example. Wyn Williams, Partner and Head of Conveyancing at Harding Evans partly attributes his department’s excellent performance during the pandemic to the stamp duty holiday and demand for houses with home offices and more outside space. But, he says:

“There are still shortages in the supply of new housing, which will become more acute if we see job losses in the construction sector.

“Similarly, if interest rates remain low and the stock market continues its sluggish performance, clients may continue to plough savings and disposable income into property.”

Demand for employment services may also continue. In August, the National Institute of Economic and Social Research (NIESR) predicted that the closure of the furlough scheme in September will result in 150,000 job losses despite the expected bounce in economic activity from the lifting of lockdown restrictions. Changes in immigration rules and employment law more generally, including as a result of Brexit, may also be a source of new work over the medium term.

One area that’s seen as a barometer for future performance is transactional work and there are positive signs here too.

James Williams, partner at Blake Morgan and Head of the firm’s Corporate Team in Wales says:

“With the pandemic now hopefully under control in the UK, we’ve noticed a real upsurge in confidence among buyers, sellers and investors. There is certainly a mix of pent-up demand, acceleration of succession plans, healthy private equity appetite and continuing low interest rates – all of which have a part to play in boosting performance in the local M&A market.

“We’ve just come off the back of a very busy summer period, and whilst it is always difficult to predict deals, even more so in a pandemic, our pipeline of deals is at a healthy level.”

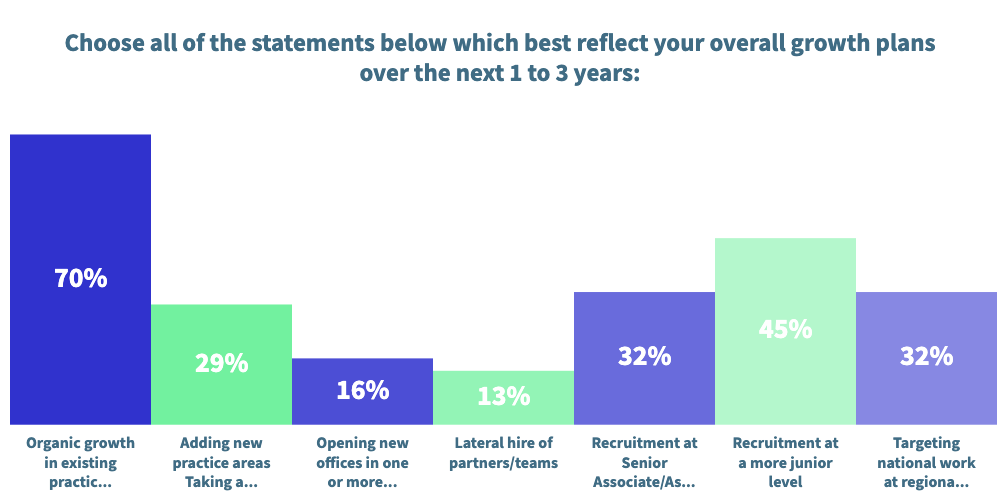

Future growth is expected to be mainly organic

In terms of growth more generally, 70% of responders say organic growth will be key to their plans over the next 1-3 years. This will be underpinned by adding new practice areas, lateral hiring and recruitment, with 45% of firms planning to recruit at a junior level and 32% at Senior Associate or Associate level.

One thing that might hamper these plans, however, is access to talent, with 1 in 3 firms identifying recruitment and staff retention as their main barrier to growth over the next 1-3 years. This view may be influenced by attempts by firms outside Wales (especially Bristol) over the last 12 months to tempt Welsh talent to join them on higher salaries with the option to work remotely – even post pandemic. An increase in demand for in-house roles may also be playing a part.

If these trends continue, firms whose growth is dependent on recruitment may therefore want to think about recruiting sooner rather than later to ensure they get access to a bigger pool of candidates.

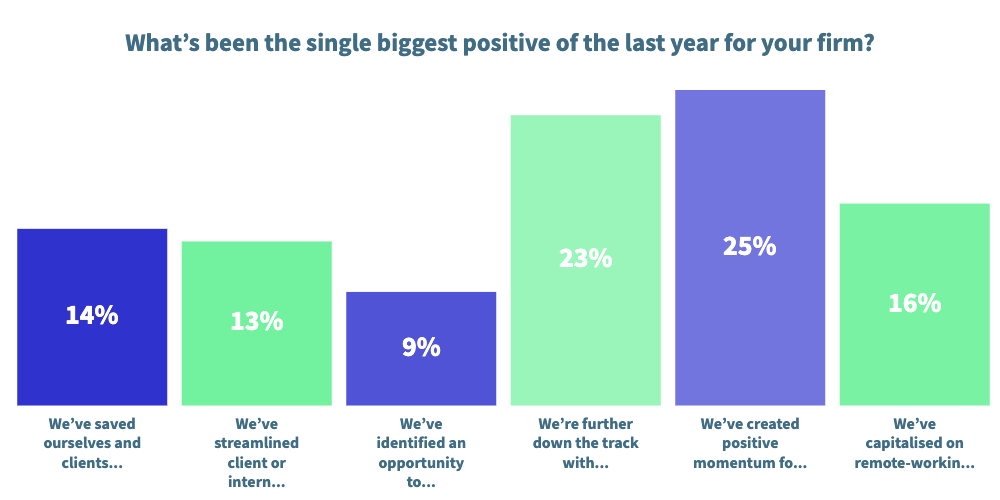

The opening up of the recruitment market has also benefitted Welsh firms, with nearly 1 in 5 seeing this, and access to new client markets, as major positives of the pandemic. A third of firms also said they’ll be looking to target UK work at regional rates as part of their growth plans, plans which may be easier to achieve with supplier location now being less of an issue for clients.

The pandemic has increased momentum for change

The forced changes to working patterns have also helped firms accelerate their flexible working plans. Although 41% of staff from firms were already working remotely or flexibly pre-pandemic, firms predict that this figure will increase to 70% post-pandemic.

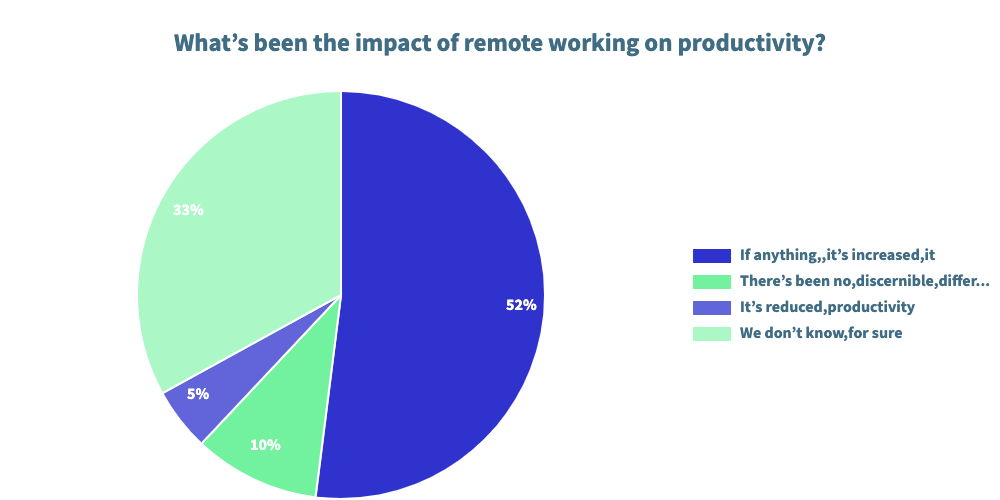

The jury is still out, however, on the impact of remote working on productivity. While 52% of our responders said think it’s increased productivity, the rest were either unsure (43%), or think it’s reduced it (5%).

Another big positive of the pandemic (cited by 25% of firms) was the fact that it’s created positive momentum for further change. Partners with healthy change appetites will find this encouraging, especially as they may not have ‘the burning platform’ of a pandemic to provide the catalyst for future change.

One approach that might grow in popularity is a ‘test and learn’ rather than ‘big bang’ approach to new initiatives – something that can de-risk decisions and help win over sceptics. It’s an approach that we’ve seen be really effective with our clients in the financial services sector.

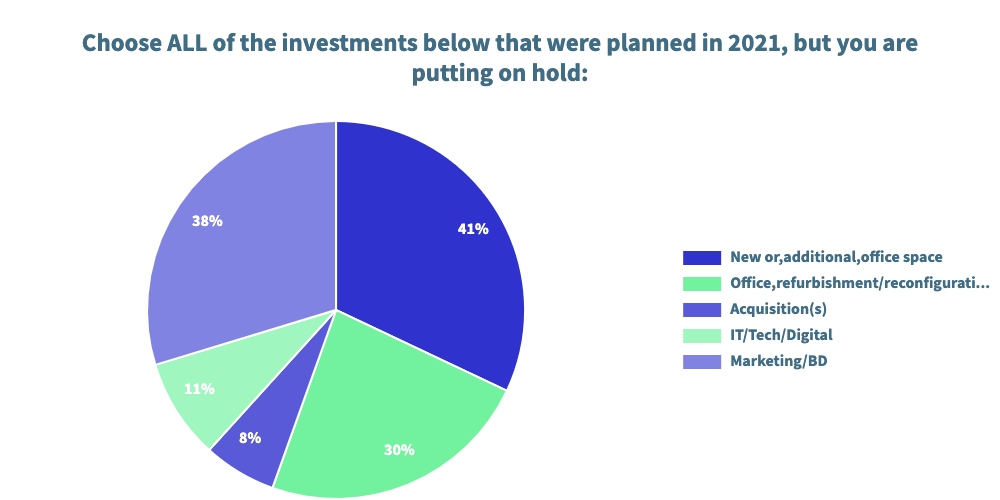

Most investment plans are on hold for now

Unsurprisingly, firms’ appetite for investment is muted at the moment, especially in terms of office spend. 41% of responders are planning to put on hold new, or additional, office spend investment, and a similar figure (30%) are postponing office reconfiguration or refurbishment plans.

A ‘battening down the hatches’ approach over the last 15 months has no doubt contributed to this sentiment, as have more recent discussions around what hybrid working and the office of the future will look like.

Perhaps more surprisingly, a third of responders have also put their business development and marketing investment plans on hold. It’s not clear why this is. It could be because the opportunities haven’t been there (especially for events and sponsorship), or because this area of spend was cut back temporarily given the uncertain climate.

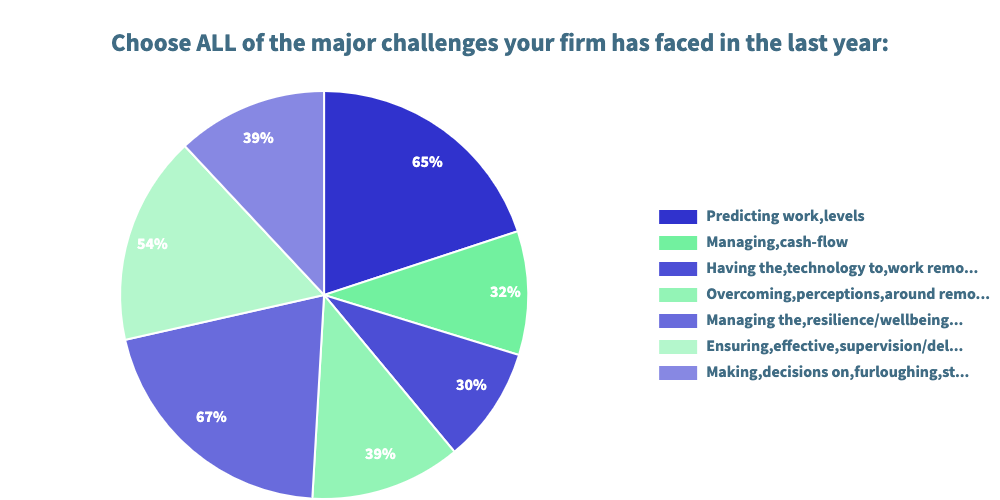

Well-being, predicting work levels and supervision have been key challenges

The pandemic has, of course, also brought challenges. The biggest, according to our survey, has been managing employee resilience and well-being, with 67% of responders mentioning it. Predicting work levels came next (chosen by 65% of responders), followed by ensuring effective supervision – experienced by just over half of the firms surveyed.

Whilst many firms have introduced a range of well-being measures and support, our experience is that they’ve been concentrated mostly on individual self-care.

It will be interesting to see if firms will take more of a team, and organisational, approach in the coming months, as many of our other clients have done – using purpose, external and internal networks and harnessing individual strengths to build resilience in a more collective sense.

Although the economic outlook remains uncertain, recent conversations suggest that firms are more optimistic about future work levels that they were at the time of the survey.

Clive Thomas, Managing Partner at Watkins & Gunn, speaks for a number of firms we work with when he says:

“Although it’s been a tough 18 months, our shared experiences have brought us closer together as we have adapted as a firm to face the challenges of the pandemic. This, combined with a healthy pipeline of new instructions and the promise of a long-awaited return to spending more time in person with colleagues and clients means we’re looking to the future with plenty of optimism.”

Supervision and delegation have understandably proved challenging with a remote workforce, and this looks set to continue with many firms that we’ve spoken moving to hybrid working.

Some firms have streamlined internal checks and balances to help them, such as reducing the paperwork needed to authorise payments. Others have invested in management skills training and one-to-one coaching to support supervisors to adapt their approach to remote working – a trend that we’ve certainly noticed, and one we expect to continue.

Summary

It’s refreshing to hear how successful firms have been in maintaining their financial performance, looking after their people and seeking out new business opportunities during what’s been a difficult period for everyone.

We’d like to say a very big thank you to the firms who participated in the survey, and wish all firms and legal businesses in Wales continued success during what will hopefully be more positive times ahead.

___

A note from the Editor

Our many thanks to Sweetmans and Partners and to Chris for his collaboration and time in creating the survey with Legal News Wales and for his analysis.

For more information on the survey and to request a copy of the results, please contact the Editor of Legal News, Emma Waddingham, by email.